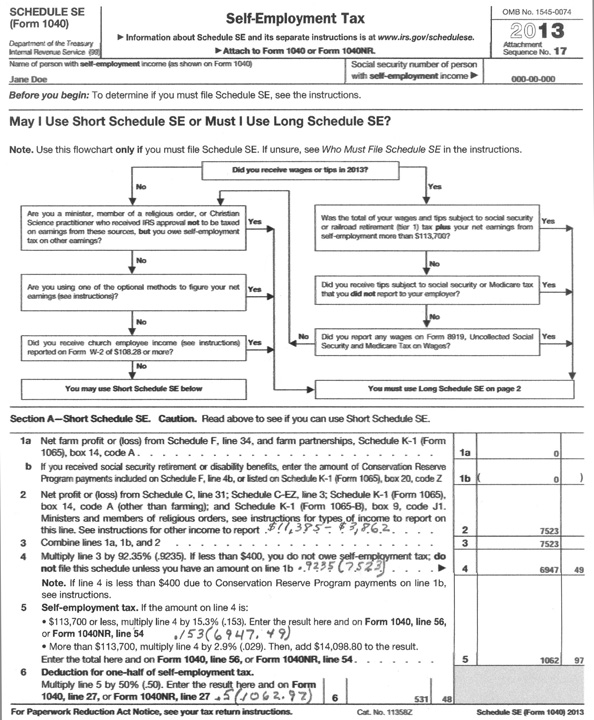

With tax season among us, the Clarion spoke with adjunct Mathematics instructor Steve Buerschen about how individuals can go about preparing their own taxes.

“Depending on your circumstances, you’ll either have to fill out a short [tax] form or a long form,” he said.

He added that students who receive financial aid might have that added as income. However, if the cost of books and tuition is greater than the amount received through Pell grants or scholarships, they may be eligible for an educational deduction.

“There’s a separate form that has to be filled out for you to indicate a loan or financial aid that you’re getting,” he said. “Financial aid counts as income. However, you can offset that by your tuition or book expenses. One of the tax credits you get is an educational credit, that counts as a deduction.”

Filing statuses depend on the individual’s living situation, and include head of household, single, jointly or widowed.

“If you’re head of household, that means you’re a single parent raising one or more children. The difference between [filing head of household and filing as a widow] is the head of household pertains to a divorced or a never-married person who is raising kids,” he said.

He added that it is a common misconception for one to believe that taxes must be paid by April 15.

“April 15 is the filing deadline; it doesn’t mean you have to pay by April 15,” he said. “If you don’t file by April 15, then you get a penalty. As long as you file and the IRS receives your tax form with no payment, they’ll send you a bill.”