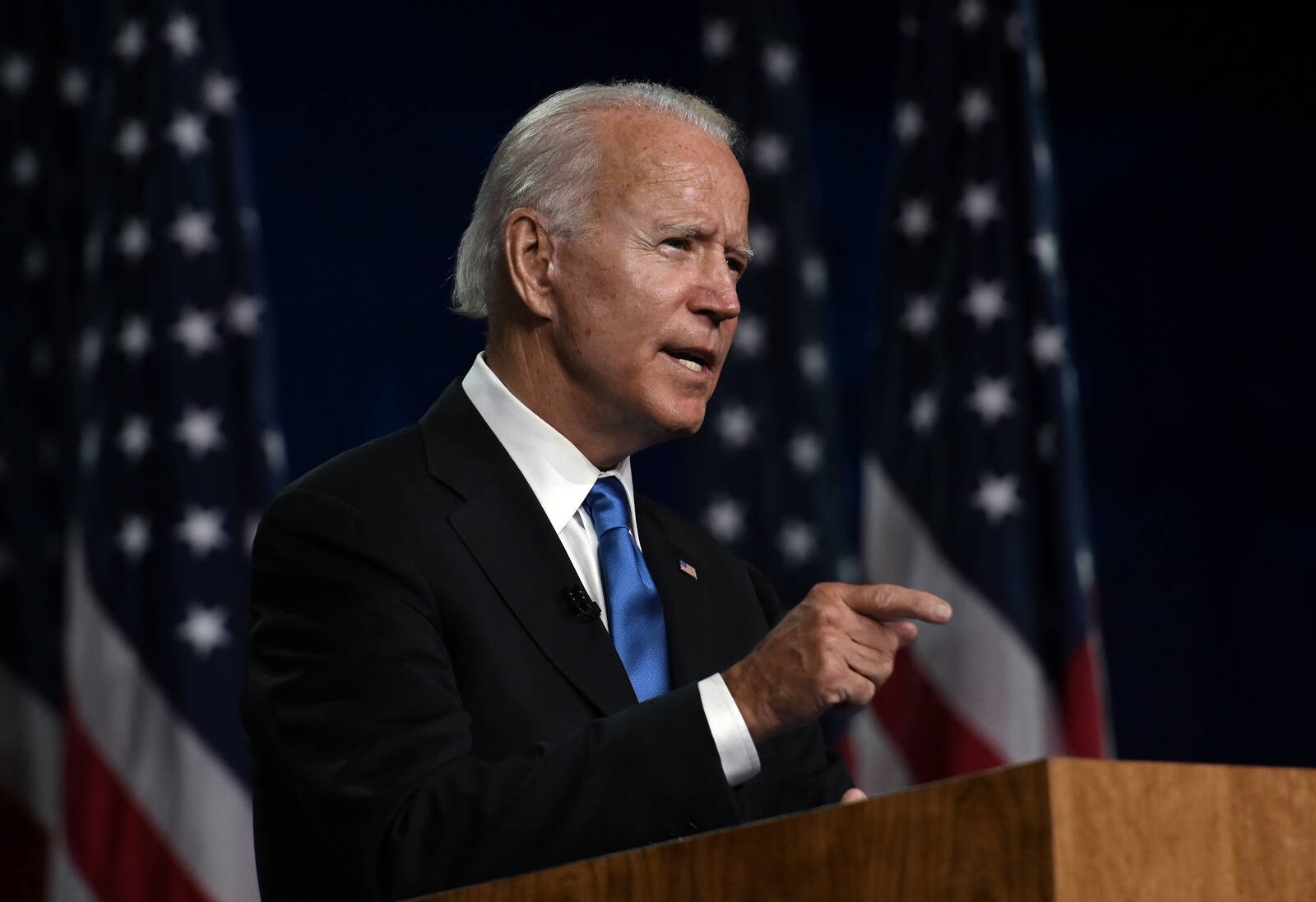

On Monday, May 17, President Joe Biden announced that 39 million American families will be eligible to receive payments as part of the American Rescue Plan Act; the Biden administration’s $1.9 trillion economic aid package. The goal of the payments is to reduce child poverty and help families who may have been economically affected by the Coronavirus pandemic.

Starting on Thursday, July 15, the International Revenue Service (IRS) will give monthly payments of $300 per child under 6 and $250 per child 6 and older as part of the expansion of Child Tax Credit Payments. For the 2021 tax year, families can receive up to $3,600 per child, compared to the prior law where families could only receive up to $2,000.

In the past, the payments have been given annually as tax refunds. However, this year the payments will be distributed monthly. Since the payments are only starting halfway through the year, the rest will be given as tax refunds.

The credit is fully refundable, meaning taxpayers can benefit even if they don’t have earned income or owe any income tax, and taxpayers can receive their payments this year before filing their 2021 tax return.

Married couples who make over $150,000 a year, parents who are heads of households who make over $112,500, and individuals who make over $75,000 are not eligible for the increased payments. Eligible parents who do not wish to receive the payments will be able to decline them through an online portal on the IRS website.

Qualifying families will receive the payments once a month from July to December of this year. The IRS is urging people with children to file their 2020 tax returns as soon as possible and is actively trying to spread information about the Child Tax Credit to the public.

Biden has proposed expanding these payments into 2025, while Republicans in Congress have criticized the plan. The expansion gives the same amount of money to parents who don’t work as those who do not and conservatives claim that will discourage parents from working.

Rachel Rosen

Staff Reporter/Social Media Coordinator